As any hospitality professional knows, there are 3 main key performance indicators in the hotel industry.

Average Daily Rate (ADR) – the average price a hotel sells its rooms (calculated by dividing the revenue by the number of rooms sold)

Occupancy Rate – the percentage of rooms in the hotel that were sold (calculated by dividing the number of rooms sold by the number of rooms available)

RevPAR – the revenue per available room (calculated by multiplying the occupancy percentage by the average daily rate)

The primary goal of any hotel is to increase revPAR by balancing the occupancy and ADR.

Rate Yield customers begin their implementation by defining their true competitive set. This selection of hotels is weighted by significance so that the client can consider even small competitors. Next, the hotel defines strategies based on booking window and occupancy rate. Finally, thresholds are put in place to limit the AI to a range in which the hotel is comfortable.

This calibration allows Rate Yield clients to define a selling price that the market can support and adjust the strategy to increase occupancy. Some clients choose to grow occupancy, while others set restrictions to promote ADR growth. Ultimately, all Rate Yield clients boast an increase in revPAR year over year.

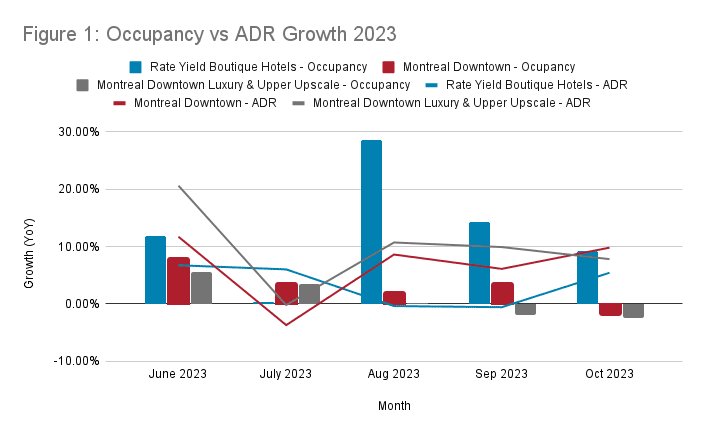

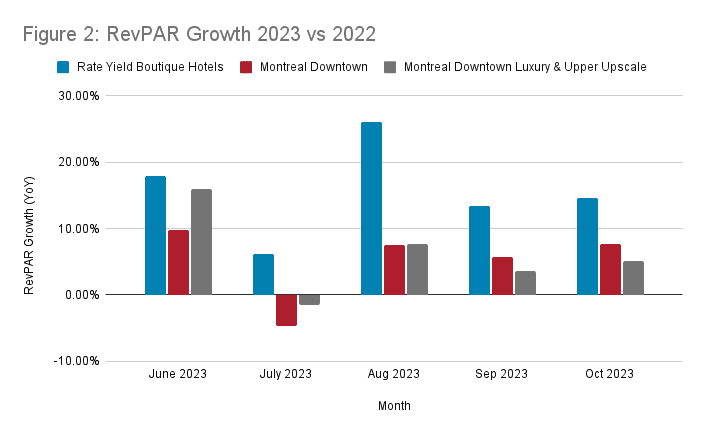

In order to assess the performance of Rate Yield, an analysis was completed comparing the ADR, Occupancy and RevPAR growth of Rate Yield’s Boutique Hotels located in Downtown Montreal as compared to the submarket data and the luxury & upper upscale hotels in the submarket, as per CoStar data.

We are very proud of the success our clients have seen as compared to the market. In Figure 1 you can see that Rate Yield clients have seen exceptional growth in Occupancy rate over the past 5 months. ADR did not grow in line with the competitive set, however the balance of the two KPIs results in RevPAR significantly above the market growth.

RevPAR grew between 2% and 18% (Figure 2) above the luxury hotels in the submarket throughout the high season in Montreal.

We look forward to continuing to prove our value throughout the winter months and beyond!