As a company based out of Montreal, it is no wonder that we have the majority of our clients in the province of Quebec. For that reason, we look to the markets of Montreal and Quebec City to provide a proper sample of what Rate Yield clients can expect as an ROI.

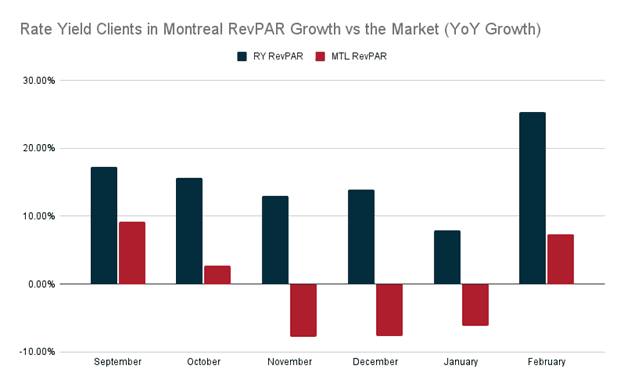

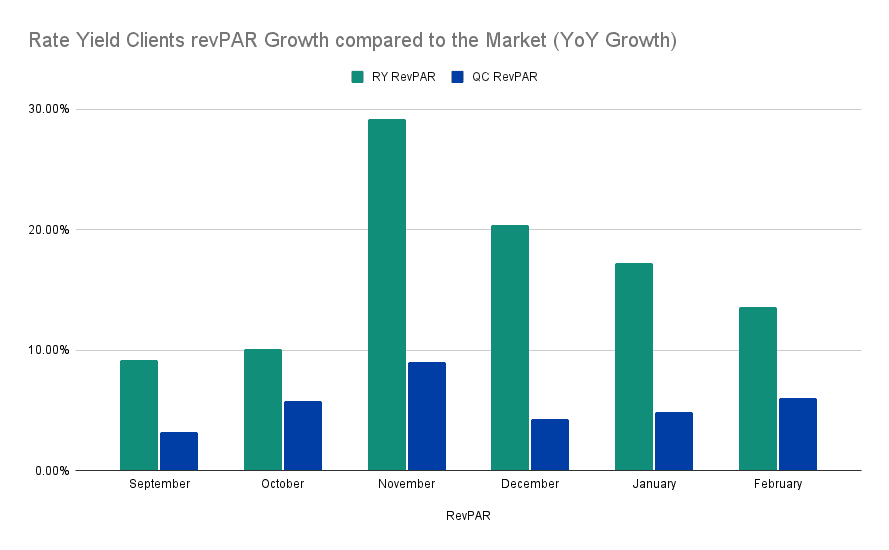

Starting with Montreal, we looked at the last 6 months, starting in September 2024 until February 2025. We can see in the chart below that Rate Yield users in Montreal are outperforming the market consistently in RevPAR growth.

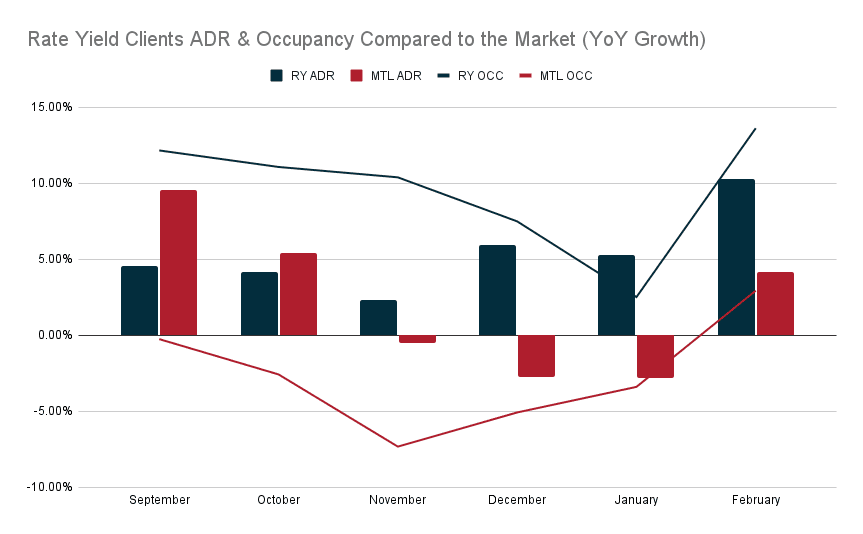

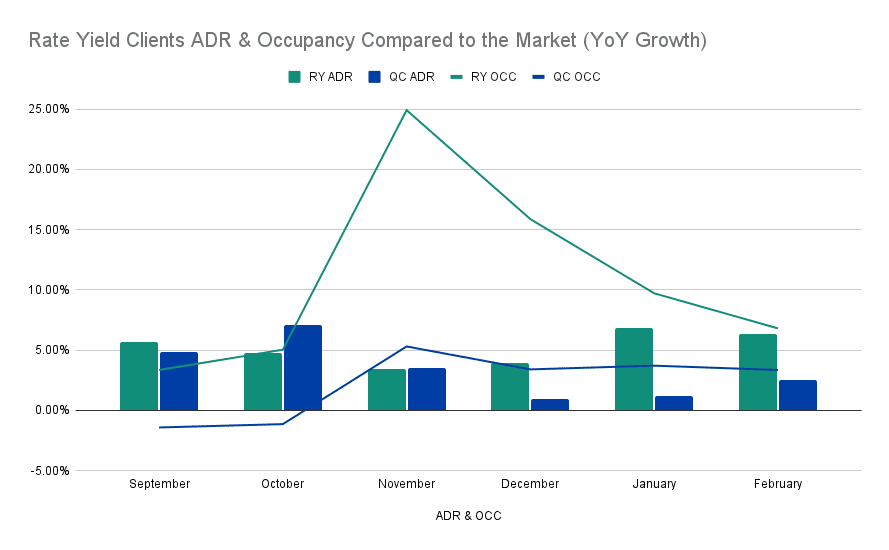

When looking at how this breaks down into ADR and Occupancy growth, you can see that Rate Yield clients consistently outperform the market in Occupancy growth and outperformed ADR growth in 4 of the 6 months studied.

This experience in September and October is a demonstration of how Rate Yield will ensure rates are competitive to reach hotel goals. While the ADR did not grow to the extent of the market, revenue in these two months grew by 17.3% and 15.7% respectively.

We see a very similar story in Quebec City. Here in green we can see that Rate Yield Clients are outperforming the market of Quebec City in blue. November has particularly high growth seen by 40% of our clients showing revPAR growth above 40% for the month.

When broken down by ADR and Occupancy, we can see that Rate Yield clients showed ADR growth above the market in 4 of the 6 months but occupancy growth above market occupancy in all 6 months. This is particularly relevant in winter months when occupancy hovers around 60%.

I am often asked what kind of growth our clients can expect to see with Rate Yield. In the case of our Montreal clients, we see an average monthly growth of 15.5% in revPAR. For the same time period, the market saw average revPAR growth of -0.4% according to STR. As such, our clients in the market saw an average return on investment of 61:1 over the last 6 months.

In the case of Quebec City, we see average revPAR growth for Rate Yield clients of 16.6% compared to 5.53% for the market. This translates to an ROI of 66:1 or 57:1 if adjusted for market growth, attributing the ROI solely to the growth Rate Yield clients saw above and beyond the market growth. This same adjustment is not done for Montreal as the market had negative growth over the same period.

We are extremely proud of these results and thrilled that our clients are getting the most of their investment. As we continue to grow and enter new markets, we look forward to seeing the ways Rate Yield will adapt to empower hoteliers, maximize revPAR and increase profitability for our clients.